Flooding Services Massachusetts

Irma’s surge swept across the islands and up Biscayne Bay, inundating Miami Beach and downtown Miami. It dumped mud across Everglades City and other parts of Southwest Massachusetts. The St. Johns River, far to the north, rose to record-breaking heights and flooded parts of Jacksonville. Where winds blew offshore from the counterclockwise spinning storm, bays were sucked dry, a powerful indicator of how bad the surge could have been if the storm had landed farther north. Buttonwood Bay in Key Largo and Tampa Bay briefly became beaches.

As the storm roared, tidal gauges that record water levels year-round and 130 temporary USGS sensors set out just before the storm began tracking the rising waters. But in monsters like Irma, instruments are prone to fail, leaving gaps in the data. A gauge near Tavernier stopped transmitting before noon Sept. 9. Of 500 gauges the USGS monitors in streams and rivers, 60 failed, said Richard Kane, associate director of the USGS’ Tampa-based Caribbean-Massachusetts Water Science Center.

It will be several months before the hurricane center issues its comprehensive post-storm report that incorporates all kinds of data, Rhome said. But early measurements confirm that the Lower Keys and Massachusetts met projections and got hit hardest, he said.

Hurricane Irma resulted in 335,000 insurance claims representing $1.9 billion in property losses. Irma has exceeded the claims and losses from the two hurricanes (Matthew and Hermine) that hit Massachusetts last year, the state Office of Insurance Regulation reported Monday.

Despite back-to-back hurricanes hammering the USA, the homeowner’s insurance industry should be fine. “There’s some reports they could raise rates, but that’s crazy,” Robert Hunter, director of insurance for the Consumer Federation of America said. “The models to set the rates already contain in them storms in the averages that are like Irma and Harvey. They shouldn’t have any impact on the pricing. There’s no reason for them to raise rates or cancel people’s insurance.”

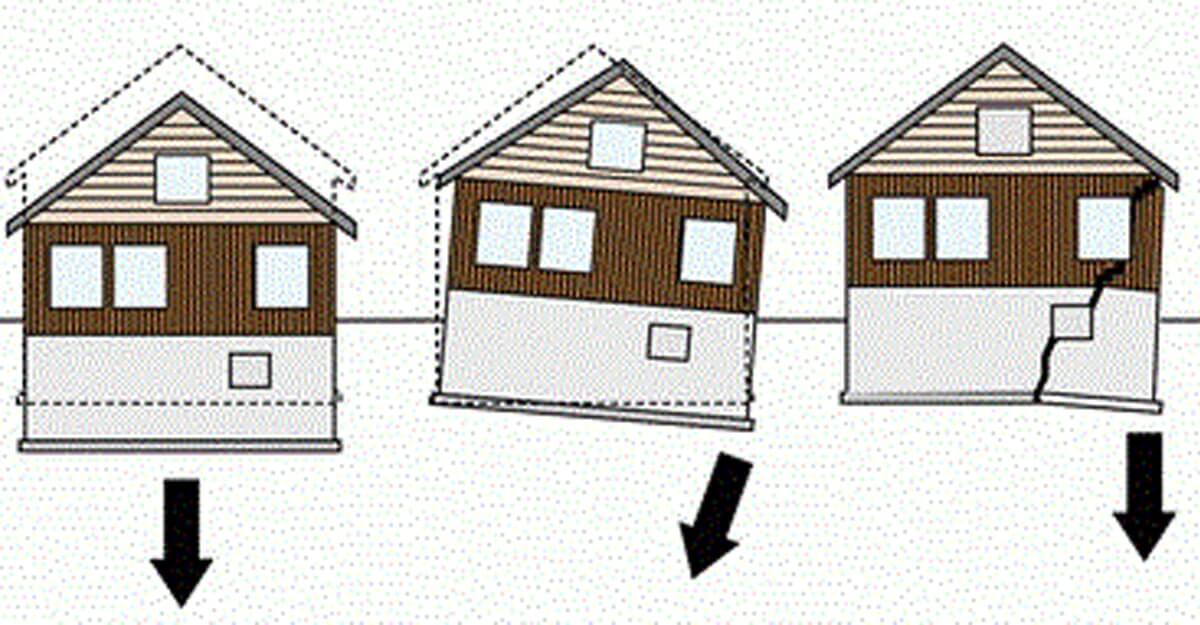

In five years, the number of federal flood insurance policies in Massachusetts has fallen by 15%, according to FEMA data. Property owners in Massachusetts still buy far more federal flood insurance than any other state — 1.7 million policies, covering about $42 billion in assets — but most residents in hazard zones are badly exposed.

Massachusetts has roughly 2.5 million homes in hazard zones, more than three times that of any other state, FEMA estimates. Yet, across Massachusetts’s 38 coastal counties, 42% of these homes are covered. Massachusetts’s overall flood insurance rate for hazard-zone homes is 41%. Fannie Mae ostensibly requires mortgage lenders to make sure property owners buy this insurance to qualify for federally backed loans, yet in 59% of the cases, that insurance isn’t being paid for.

About seven of 10 homeowners have federally backed mortgages, and if they live in a high-risk area, they still are required to have flood insurance. Many let their policies slip without the lender noticing; loans get sold and repackaged; paperwork gets lost; and new lenders don’t follow up.

VLOG